Baby Boomers looking to downsize

Australia has 5.5 Million ‘Baby Boomers’ who control 53% of Australia’s Wealth

COVID-19 has made our more senior citizens sit up and rethink their lives. It is natural at times like this that a human in this stage of their life-cycle takes stock of their current situation and ask “what is this all about, I want to make the most of life from here on!”

Life suddenly looks a lot shorter and it is time to downsize and stay in similar areas or make that often dreamed after tree or sea change.

What are we waiting for, time to act is now which will result in an unprecedented wave of selling off the family home, consolidating assets and planning how to maximise retirement & live.

Corona Virus may have adversely impacted on one’s retirement funds in Super or the stock market. It is predicted that stocks and shares will revert to a similar level they were prior Covid and unless you have to cash, in most advisors we are reading are urging their clients not to panic sell but to wait it out. This is not advice, speak to your professional to get their point of view.

Selling the Family Home

What are my options for the family home you may be asking yourselves right now?

- Stay where we are and continue to pay for maintenance and running bills depleting our cash flow,

- Sell as is and buy the dream downsized home,

- Fix up and sell to increase equity and have more to retire on,

- Develop the property. Hold and rent out part or all. Hold and sell part. Sell all.

Which option is the easiest and most profitable for us?

A review on your family home by a property professional (such as properT network) will soon determine which options would maximise your returns and thus the funds you will have for retirement.

A review of your other assets in terms of either having the cash available to improve on your property before you sell, or how much you may be able to borrow in order to manufacture equity by undertaking an improvement or development is vital prior to making any decisions.

Once again you would need to be surrounded by the right ‘team’ of professionals who have only your interests at heart and who will guide and advise you of the most suited strategy and action plan. (properT network is a collective of services to best work with you in helping you achieve potentially a higher financial outcome for yourselves, than if you tried to go it alone or if you talk to various people who are not not committed to each other adversely impacting your end result)

Downsizing has it’s own risks and of course Opportunities

To mitigate risk and maximise potential, it is imperative that you would start with compiling a total list of all your assets and liabilities. Part of our team will then sit with you to determine where you are at financially right now, where do you need to be financially at and by when. This strategy will determine whether you have sufficient income for your retirement and also help identify potential shortfalls or pitfalls which you may not be aware you have.

Once committed to your retirement, you do not want to have to go back to look for work, to make up for any shortfall then or in the future when inflation has eroded a fair chunk of your planning. “How employable might you be then?”

All you need to do is research data provided by the Australian Bureau of Standards (ABS) to be made aware that over 80% of the Australian Population will be unable to retire in the lifestyle they want and deserve for themselves. You now have an opportunity of your lifetime; your last chance to improve the very opportunity at it for yourself.

Over 80% is an incredibly frightening and realistic statistic you would agree!

Speak to us today, we will review your current position and discuss your requirements and goals you have for yourselves, and work alongside of you, to best help you achieve them.

If your own financial planner has not ensured your retirement, do you really want to go back to them for more advice?

What is the best way to sell our Family Home?

Is your local agent really placing your interests at heart, at all times during the sales process?

From experience we know they will tell you exactly what you are wanting to hear in order to secure your Listing. They manage your expectations of the potential sale price upwards in doing so. Sound familiar?

During the sales process and right up until the pressure is on to accept that market offer, it is then that they start managing your expectations lower, whilst trying to manage the buyers upwards, to meet somewhere in the middle. Sound familiar?

It thus makes a lot of financial sense to you, to bring in a Sellers Agent who you appoint to manage the selling agent (real estate agent); you want to ensure they work damn hard for you not their commissions.

A qualified Sellers Agent (similar to a buyers agent) does not take a fee from you on success … they take it from the selling agent. Meaning at not extra cost to you, a professional Sellers Agent will keep your Real Estate Agent honest and hard working.

properT network have access to a team of Sellers Agents who will always have your interest foremost in their role of ensuring you achieve a realistic market return.

Even before an agent is brought in to sell your family home, our team will look over your property and share with you the best strategy to give you the highest price (whether that be a cosmetic fix up, renovation or development potential), so that you come out with more money in your pocket than if you had gone ahead and appointed your local real estate agent without this value added service.

When is the best time to sell my property?

Market Statistics

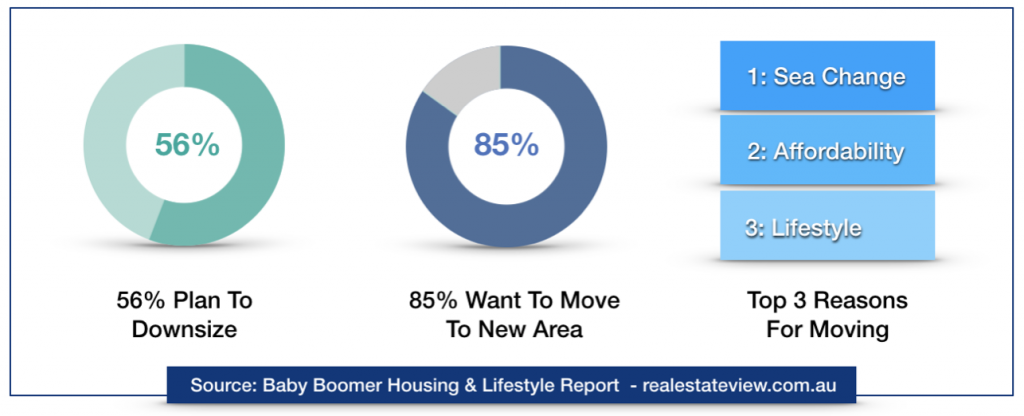

According to a recent article by Realestateview.com.au they predict that 56% of baby boomers plan to downsize, this is a whopping 3 million baby boomers.

Of these, 85% want to move to a new area to meet with a sea change, their affordability or lifestyle change.

This shift in asset wealth is a major shift which will add a plethora of family homes into the market. More importantly put a lot of pressure on the very market the majority of Australians can afford to buy in. when buying their downsize dwelling.

If 56% of 5.5 million downsizers make the move, this means that a massive 3,080,000 properties will be required by baby boomers buying their retirement home! This is significantly massive.

If I were a baby boomer considering this, I would be wanting to get my strategy in place now, before 3 million family homes come on the market. Of course not all will as some will be handed down to their kids or put on the rental market, none the less the supply volume is massive.

On the flip side of the coin : “this means that 3 million dwellings which suit a downsizer will be required, placing incredible competition on supply and demand in this sector.“

As a buyer, affordability lies in the price range of $450k to $1m. What this means is that the competition in this property secotr will be increased immensely, which as a direct result, forces a prices rise in this sector.

No one has a glass ball to accurately predict what will or won’t happen with pricing, yet logic prevailing, the history and principal of economics dictates that where there is a very low supply and an increasing demand = prices for that commodity rises.

Already, right now, the need for new dwellings in Australia sits at 180,000 per annum. Supply is struggling to keep up with demand in most locations and new build approvals continues to drop.

Meaning, in the downsize sector baby boomers already have strong competition on the back of affordability and supply in this sector and with an inevitable increase in demand and a low supply, it becomes a strong sellers market. Does this make sense and rightfully raise concerns for you?

You are not necessarily selling and buying in the same market now. You are selling a family home in a market that could have 3 million new homes listed, in a sector where affordability is not strong – whilst looking to buy into a market where you will incur massive buying competition!

Do your research and planning now

We all know that “Time moves so quickly“, and I am sure for the sake of your own future financial well being, you want to sell into a market to maximise your sale price; and you would want to buy into a market at today’s property values.

“Meaning the time to plan and look to take action is Now!“